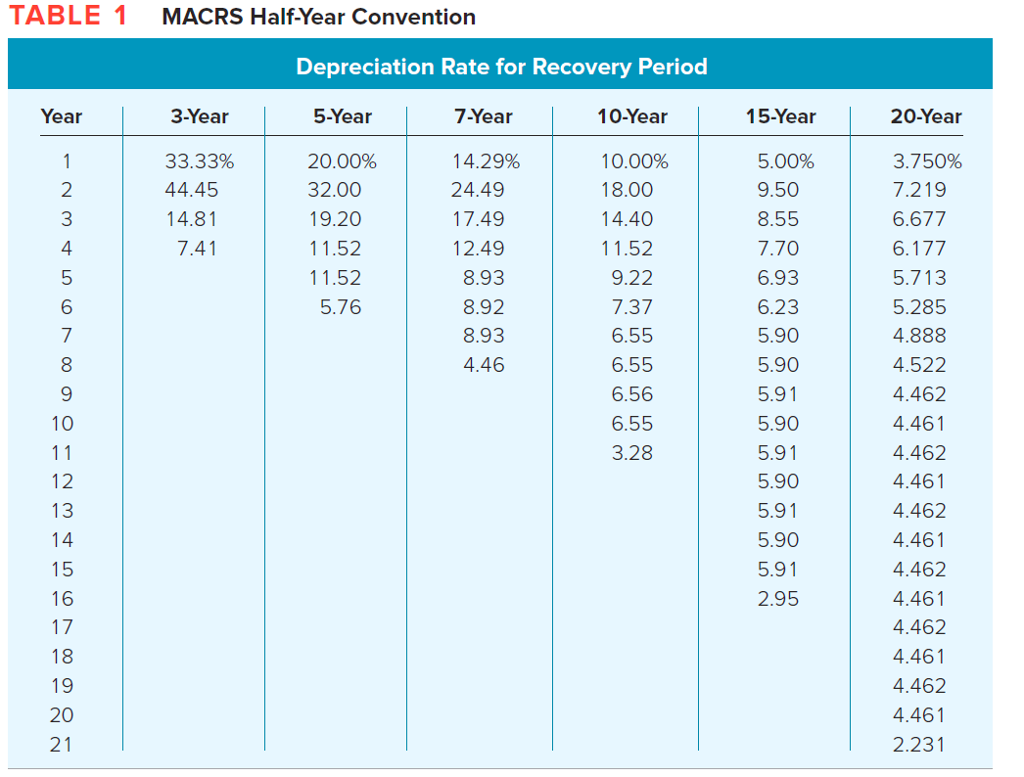

The other side of the depreciation expense is a credit entry to the accumulated depreciation account. Totaling the figures in the right column, you find that the total cost of MACRS depreciation for the vehicle is $40,000. As you might have guessed, that means you claim six months of depreciation in the year the property 150 declining balance depreciation is placed in service and six months of depreciation in the year you remove the property from service. When using the mid-month convention, a taxpayer takes half a month of depreciation in the month the property is placed in service and half a month of depreciation in the month the property is removed from service.

Declining Balance Depreciation Method

These conventions help determine the portion of the year to depreciate property in both the year the property is placed in service and the year it is taken out of service. When compared to the straight-line method of depreciating property, MACRS depreciation allows a taxpayer to take a larger tax deduction in the early years of an asset’s life and smaller deductions in the later years. This, of course, reduces taxable income early in the asset’s life but increases it down the road. Depreciation is an annual allowance given to a trade or business for exhaustion, wear and tear, and normal obsolescence of property. You can depreciate most types of tangible property, such as buildings, machinery, vehicles, furniture, and equipment—but not land. When I worked as a financial analyst at a major corporation, my work routinely required me to create models for business transactions, financial scenarios, and program cost-effectiveness assessments.

Double-Declining Balance (DDB) Depreciation Method Definition With Formula

On the same date, the property had an FMV of $180,000, of which $15,000 was for the land and $165,000 was for the house. The basis for depreciation on the house is the FMV on the date of change ($165,000) because it is less than Nia’s adjusted basis ($178,000). Other basis usually refers to basis that is determined by the way you received the property. For example, your basis is other than cost if you acquired the property in exchange for other property, as payment for services you performed, as a gift, or as an inheritance. The basis of property you buy is its cost plus amounts you paid for items such as sales tax (see Exception below), freight charges, and installation and testing fees.

Placed In Service Date for MACRS Purposes

TAS strives to ensure that every taxpayer is treated fairly and that you know and understand your rights under the Taxpayer Bill of Rights. Go to IRS.gov/WMAR to track the status of Form 1040-X amended returns. Form 9000, Alternative Media Preference, or Form 9000(SP) allows you to elect to receive certain types of written correspondence in the following formats. The IRS Video portal (IRSVideos.gov) contains video and audio presentations for individuals, small businesses, and tax professionals.

- The following are examples of some credits and deductions that reduce depreciable basis.

- Qualified reuse and recycling property does not include any of the following.

- Under the 200% declining balance method, it would be $2,400 (40% of the $6,000 remaining depreciable basis).

- But that investment would pay off over many years in a number of ways.

- After you have set up a GAA, you generally figure the MACRS depreciation for it by using the applicable depreciation method, recovery period, and convention for the property in the GAA.

- This use of company automobiles by employees is not a qualified business use.

Table of Contents

You figure your share of the cooperative housing corporation’s depreciation to be $30,000. Your adjusted basis in the stock of the corporation is $50,000. You use one-half of your apartment solely for business purposes. Your depreciation deduction for the stock for the year cannot be more than $25,000 (½ of $50,000). Your depreciation deduction for the year cannot be more than the part of your adjusted basis in the stock of the corporation that is allocable to your business or income-producing property.

Real property, generally buildings or structures, if 80% or more of its annual gross rental income is from dwelling units. The number of years over which the basis of an item of property is recovered. Expenses generally paid by a buyer to research the title of real property.

Similarly, compared to the standard declining balance method, the double-declining method depreciates assets twice as quickly. If the depreciation deductions for your automobile are reduced under the passenger automobile limits, you will have unrecovered basis in your automobile at the end of the recovery period. If you continue to use the automobile for business, you can deduct that unrecovered basis after the recovery period ends. You can claim a depreciation deduction in each succeeding tax year until you recover your full basis in the car. The maximum amount you can deduct each year is determined by the date you placed the car in service and your business/investment-use percentage. You can claim the section 179 deduction and a special depreciation allowance for listed property and depreciate listed property using GDS and a declining balance method if the property meets the business-use requirement.

Multiply the amount determined using these limits by the number of automobiles originally included in the account, reduced by the total number of automobiles removed from the GAA, as discussed under Terminating GAA Treatment, later. Special rules apply to figuring depreciation for property in a GAA for which the use changes during the tax year. Examples include a change in use resulting in a shorter recovery period and/or a more accelerated depreciation method or a change in use resulting in a longer recovery period and/or a less accelerated depreciation method. Under the simplified method, you figure the depreciation for a later 12-month year in the recovery period by multiplying the adjusted basis of your property at the beginning of the year by the applicable depreciation rate. You figure the SL depreciation rate by dividing 1 by 4.5, the number of years remaining in the recovery period. (Based on the half-year convention, you used only half a year of the recovery period in the first year.) You multiply the reduced adjusted basis ($800) by the result (22.22%).

Under the 200% declining balance method, it would be $2,400 (40% of the $6,000 remaining depreciable basis). A business can also opt to use the ADS for all property in a property class that’s placed in service during the year. However, an election for residential rental property or nonresidential real property can be made on a property-by-property basis. Depreciation rates used in the declining balance method could be 150%, 200% (double), or 250% of the straight-line rate.

If you dispose of GAA property in an abusive transaction, you must remove it from the GAA. For this purpose, the adjusted depreciable basis of a GAA is the unadjusted depreciable basis of the GAA minus any depreciation allowed or allowable for the GAA. You can use either of the following methods to figure the depreciation for years after a short tax year. The DB method provides a larger deduction, so you deduct the $192 figured under the 200% DB method. The DB method provides a larger deduction, so you deduct the $320 figured under the 200% DB method.

This election does not affect the amount of gain or loss recognized on the exchange or involuntary conversion. If you hold the property for the entire recovery period, your depreciation deduction for the year that includes the final quarter of the recovery period is the amount of your unrecovered basis in the property. The following table shows the declining balance rate for each property class and the first year for which the straight line method gives an equal or greater deduction.